What I wish I knew when exploring Cardano

This documentation is a collection of tips and secret knowledge that may be useful in your Cardano journey. Some may never be useful to you or only useful in the distant future. Yet, we hope that if we can save someone a few hours of debugging and hunting down rabbits in bottomless holes, we have accomplished our mission.

CBOR / CDDL

Pretty much everything in Cardano that requires serialization is done using a a structured binary format called CBOR (opens in a new tab). Think of it as JSON but for binary data. You don't have to be an expert in CBOR to work on Cardano, but being familiar with the notation can be useful especially for troubleshooting low-level stuff.

There are two specific areas worth knowing:

-

CDDL, which is a specification meta-language for CBOR. It's used to describe how some data is encoded into bytes. In particular, the Cardano ledger maintains a CDDL specification of all the Cardano objects (opens in a new tab) that have to be serialized on-chain. Transaction serialization, for example, is entirely specified in this document. This specification is generally the source of truth for many other tools.

-

CBOR diagnostic provides a more human-readable, JSON-like syntax that is handy for debugging. We explain CBOR diagnostic in more detail in the Troubleshooting section.

A well-known tool for debugging CBOR is cbor.me (opens in a new tab); there are also numerous command-line utilities in various languages.

Byron Addresses

Cardano has two kinds of addresses, which are called by different names depending on who you ask. Prior to the introduction of the Shelley era, addresses looked vastly different than what they look like today.

For example: Ae2tdPwUPEYz6ExfbWubiXPB6daUuhJxikMEb4eXRp5oKZBKZwrbJ2k7EZe.

We call these addresses "Bootstrap addresses" or simply "Byron addresses"; in contrast to other addresses that are either called "addresses" or "Shelley addresses" when there's a possible ambiguity. Byron addresses are considered deprecated today and are likely not something you want to use ever. But, you might come across them, for some legacy systems still use them.

Outputs locked by a Byron address or inputs corresponding to such outputs are forbidden in transactions that have Plutus scripts! This means that on-chain validators should never encounter Byron addresses in a validation context. This used to be different in the early days of the Alonzo era but was later changed to avoid hazardous situations.

Validity Intervals

You probably know already that Cardano smart-contract execution is fully deterministic.

This, however, raises an interesting question: How to deal with time?

Asking for the current time usually breaks determinism because asking the same question at different moments may lead to different answers and, thus, different execution paths. So how to introduce time in scripts validating transactions?

Cardano decouples transaction validations in two phases, and we typically refer to them as "phase-1 validations" and "phase-2 validations". Phase-1 validations are structural checks on a transaction performed by the ledger. For example, this is when the ledger verifies that inputs referenced in a transaction are valid, that minimum amounts for fees and outputs are met, etc...

Among the available features of a transaction are "validity intervals" that define a period after which and until the ledger can consider the transaction valid. The validity interval is made of a lower bound (optional) and an upper bound (optional), and it is verified during phase-1 validations. That is if a transaction is said to be valid only after the 5th January 2030, it can only be submitted and considered valid by the ledger after that date. Similarly, if the validity interval defines an upper bound, then the transaction will sit in mempools until then. It is pruned if it doesn't make it into a block by the specified date.

Thereby, one can introduce a notion of time in validators through the means of validity intervals. Since they are checked during phase-1, a validator can assume that the transaction it validates is within the specified validity interval. Hence, should you ensure that an action happens only after a specific date, you can record that date as a datum and check that the transaction's lower bound is greater than the specified date.

The validity interval can be as narrow as one second, allowing scripts to run at very thin precisions. However, a narrow interval means getting the transaction in a block may be more difficult. As a reminder, there's one block every 20 seconds on average minted on the Cardano blockchain. Blocks are usually propagated fast, but it can take a few minutes under moments of heavy load.

Serialization strategies

There's no canonical serialization of objects on Cardano. While there is indeed a CDDL specification for core objectssee below, as mentioned earlier, there are still multiple possible interpretations possible of the specification. For example, a CDDL specification is unable to express in what order should keys in a map be serialized, or whether optional fields with default values (e.g. an optional list of elements) should be omitted entirely or specified with an empty default value.

While there are attempts, such as CIP-0021 (opens in a new tab) to agree on a canonical serialization; the current Cardano ledger does not provide any such guarantee. Consequently, the recommended strategy when dealing with deserialized objects that need to be reserialized is to always preserve the original bytes and not attempt to reserialize anything. At the same time, parsers should not assume one way over another and be ready to deserialize any possible representation that is compliant with the CDDL specification.

This means, amongst other things, that there are multiple possible serializations of a transaction, and it may lead to surprising situations when trying to recalculate the hash of an object.

CDDL files

| Era | CDDL Specification |

|---|---|

| Byron | byron.cddl (opens in a new tab) |

| Shelley | shelley.cddl (opens in a new tab) |

| Allegra | allegra.cddl (opens in a new tab) |

| Mary | mary.cddl (opens in a new tab) |

| Alonzo | alonzo.cddl (opens in a new tab) |

| Babbage | babbage.cddl (opens in a new tab) |

| Conway | conway.cddl (opens in a new tab) |

Hash digests

Cardano uses mostly only blake2b as a hashing algorithm throughout the chain. Saying "mostly" because we can find some examples of SHA-256 in some parts of the Byron era, but let's not dwell on that.

Many things called id are hash digests of some serialized objects.

For example, a stake pool id is a hash digest of the pool

public cold key. A transaction id is a hash digest value of the serialized

transaction body. And so forth.

Hashes are generally 32-byte long on Cardano (or 256 bits), except for credentials (i.e. keys or scripts) which are 28-byte long (or 224 bits). This is why a policy id is only 28 bytes long: a policy id is the hash digest of a tagged script, and scripts can be used as credentials (i.e. part of an address). The same goes for any hash digest of a verification key.

Policy Id and language tags

A policy id is a hash digest of a tagged script. Tagged is the keyword here. Should you try to calculate the policy id by simply hashing a serialized script, you may find yourself with a wrong hash without knowing why.

Raw scripts aren't exact pre-image of their hash digest. Before hashing,

scripts are prefixed with a certain discriminator byte depending on the

language. For instance, any native script is prefixed with a 0x00

(0b0000_0000) byte before hashing.

Here's a table summarizing all discriminators:

| Language | Discriminator Byte |

|---|---|

Native | 0x00 |

Plutus V1 | 0x01 |

Plutus V2 | 0x02 |

Plutus V3 | 0x03 |

The subsequent versions of Plutus may likely follow the pattern.

Rewards & Withdrawals

Ouroboros, the consensus algorithm used by Cardano, defines an incentive mechanism for stakeholders to participate in the consensus through rewards. Of course, you probably know that by now. Rewards are paid every epoch to delegators that delegate their stake (i.e. ADA tokens) to a stake pool of the network producing blocks on their behalf. Those rewards are, however, not paid directly to stakeholders; this would cause the network at every epoch boundary to pay out all rewards.

Instead, Cardano has introduced a restricted concept of account, similar to what exists on account-based ledgers. This account is, however, singular in many ways:

- It is defined by some stake credentials and owned by them;

- It can only receive rewards from the protocol but not from a user-defined transaction;

- It is automatically delegated;

It is possible to withdraw funds from the account by issuing a withdrawal (which takes the form of a specific field in a transaction). A withdrawal sets the balance of an account to 0 and provides a virtual pot of the account value to the transaction carrying it as if it was an input of that same value. That value can then be dispatched in one or more UTxO, as typically done with any input.

The stake credentials associated with the account protect withdrawals as well. Who owns the stake credentials owns the right to withdraw from the account. This means that reward withdrawals can be commanded by a script (and thus an Aiken program).

Native Scripts

Before full-blown Plutus scripts, Cardano had a minimalistic scripting language

usually referred to as "Native Script" or "Phase-1 scripts". It still

exists and provides simple, albeit useful, programmability features to Cardano.

Native scripts come in the form of a little domain-specific language with 6

constructors: key, all-of, any-of, n-of-m, after and before.

In particular, they are quite handy in defining multisig addresses owned by multiple tenants. You can find more about native scripts in CIP-1854 (opens in a new tab) and in the Formal Ledger Specification, Figure 4: Multi-signature via Native Scripts (opens in a new tab).

The 'clean' trick: avoid replaying blocks

Sometimes, the Cardano node will perform a complete re-validation of the chain as an integrity check. It does so by scanning through its local files, and replaying blocks onto each other. On Mainnet, this procedure can take multiple hours and is caused, in principle, by mainly two things:

- A restart after a non-clean shutdown of the node (e.g. a SIGKILL, or power outage);

- A critical change in the ledger version.

The detection of the first scenario is sometimes a bit clunky, and the unlucky ones amongst us have likely already experienced (sometimes several times) the infamous:

Replayed block: slot 3844799 out of 112665654. Progress: 3.41%

Replayed block: slot 3844783 out of 112665654. Progress: 3.42%

...It turns out that there exists a way to skip re-validations of the first kind.

Indeed, on start-up, the node will look for an empty file named clean at the

root of its database folder.

node.db/

├── clean <------------ this fellow

├── immutable

├── ledger

├── lock

├── protocolMagicId

└── volatileWhen present, the node will not replay blocks, unless it detects a critical

change in the ledger (second scenario) which happens fairly rarely. So it

suffices to create such a file (e.g. touch node.db/clean to avoid replaying

blocks unecessarily. This is a useful trick to use when developing with a local

node, but totally unsound in a production setting (especially for SPO).

Transaction latency vs finality

In a distributed system like Cardano, the notion of latency and finality are often misunderstood (or swapped). Yet, it is crucial to get them right especially when it comes to transactions.

Latency is the time it takes for a transaction to appear on the blockchain, in a block. Finality is the time it takes for a transaction to become immutable and permanent. Why is that different? Because the system is distributed! And that means the information is only eventually true. How long is enough depends on the interested parties and the type of transaction.

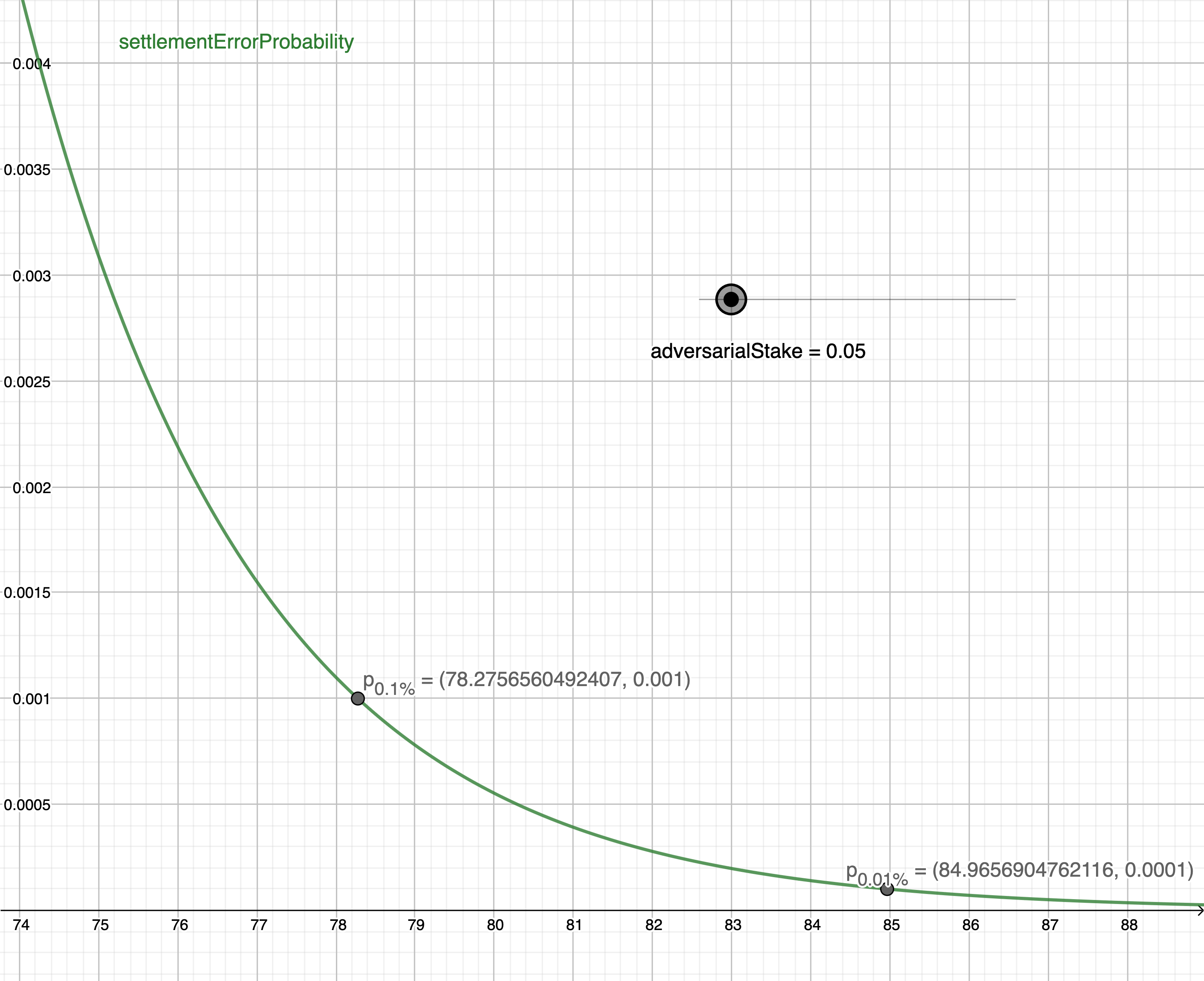

It is hard to give a definite answer because finality directly depends on the

proportion of adversarial stake in the system. And unfortunately, adversaries

don't walk the street waving their hands about the fact they are, in fact,

adversaries. If we call ε the proportion of adversaries ([0;0.5]), and consider g

their grinding power we find that under Ouroboros Praos (current Cardano

consensus algorithm), the probability of settlement errors in terms of the

number of blocks (x) is given by the following equation:

Now, what are good values for ε and g is hard to say. Regarding the

grinding power, values in the range of 10^9..10^10 are quite conservative

values. The entire Bitcoin network has a grinding power of about 10^12. So

unless the entire Bitcoin network is attacking Cardano, g is likely smaller

than 10^12. For the adversary proportion, as a rule of thumb, it's good to

look at the total stake of the largest stake pools to get an idea of how much

power can a single entity gather.

A good recommendation for sensitive transactions is thus to wait around 100-150 blocks (30-50 min) whereas a few blocks is usually sufficient for small payments. If you want to play with the equation, feel free to look at this interactive calculator (opens in a new tab).

Developer Portal

There exists plenty of resources available on Cardano. Though there are a bit hard to find sometimes. As a rule of thumb (and unfortunately): avoid http://docs.cardano.org (opens in a new tab) as it is often inaccurate, plain wrong or missing crucial elements.

On the other hand, the Cardano Developer Portal (opens in a new tab) is a good entry point to many of the ecosystem tooling and resources. The "Builder Tools" section is particularly furnished. It is community-maintained, curated and under constant evolution. Feel free to contribute and ask questions there as well!